Insights

Treasurer Jim Chalmers last night handed down the the latest Labor party budget. In summary, the budget aimed to address the key issues such as cost of living while also keeping one eye on the upcoming election. Please enjoy our analysis of the budget and what it means for you and/or your business.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Treasurer Jim Chalmers last night handed down the the 2023 Labor party budget. In summary, the budget aimed to provide cost of living support to those who need it most while also doing so in economically responsible manner. Please enjoy our analysis of the budget and what it means for you and/or your business.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Treasurer Jim Chalmers last night handed down the first Labor party budget in over 10 years. Given the very complicated economic climate, this was one everyone was naturally eagerly awaiting - both individuals and businesses alike. Please enjoy our analysis of the budget and what it means for you and/or your business.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Today we discussed a number of topics on our minds in light of this coming weekend's election.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

In light of the current market conditions, today we explored the theme of Passive Investment across these topics:

• What does increased volatility mean for passive investors right now?

• Has the significant rise in passive investment given too much power to large institutions via their voting rights?

• Is passive investing in times like this simply making life easier for active managers?

• Should we always remember the "time in the market" term during volatile times?

• What to take out of the recent twitter discussion between Elon Musk, Marc Andreessen and Cathie Wood.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Interest Rates Go Up! - In this week's Pulse Check, we are going to discuss the Reserve Bank's decision to raise interest rates for the first time in 11 years at their board meeting this afternoon. With their decision to raise rates by 25 basis points, thereby moving the cash rate to 0.35%, this naturally has a significant flow on effect across the board. Some of the key areas we will look to discuss in tomorrow's session include:

• What does this change mean for the economy?

• How significantly will this rise impact bond markets?

• What does this mean for investors?

• What does this mean for retirees?

• What are the potential flow on effects for the housing market?

• Does this change anything with regards to the upcoming election?

Treasurer Josh Frydenburg last night handed down the belated Federal Budget. Please enjoy our analysis of the budget and what it means for you and/or your business.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Market Update - In this week's Pulse Check, we are going to take a in depth look at the state of markets and discuss some of the key drivers behind these, both post and present. Some of the key areas we will look to explore include:

• How have markets been performing in general both over the past few weeks and also the 2021/22 Financial Year to date.

• What has been driving the increase in market volatility of late.

• Recent events impacting on markets; the ongoing pandemic, inflation and the situation in the Ukraine to name a few.

• Current events impacting on markets; interest rates, bond yields and the upcoming federal election.

• A look ahead for the remainder of 2022.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Let's Talk Politics! - In this week's Pulse Check, we are going to tread dangerous ground and talk all things politics! As mum and dad always taught us, you should never discuss politics but in tomorrows session we are going to break one of the unspoken rules and delve right in!

Some of the key questions we are going to look to discuss include:

• The Reserve Bank; Is there a lack of independence showing here..?

• The art of leadership; are ScoMo or Albo displaying this right traits at the current point in time...?

• Both parties are promising no increase in taxes and cash handouts to boot. While this sounds great, does this ultimately mean something has to give in terms of services...?

• Tax reform; Is this something we could be discussing for the greater good or should we follow the governments lead and keep kicking the can down the road for now..?

• Do the current pre-election polls tell the real story..?

• What does the election result mean for markets..? Is there a good or

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our summary of last night's Federal Budget.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

The Latest Headlines - In this week's Pulse Check, we are going to take a quick look at the latest headlines and briefly discuss the impact this has on the financial state of play. Some of the key headlines we will look to discuss include:

• The South Australian election result and what this means for the upcoming federal election

• The continuing escalation in inflation

• The raising of rates by the US Federal Reserve

• The movement in the US yield curve and what this means for us

• The continuing conflict in the Ukraine

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

The Importance of Goal Setting - In this week's Pulse Check, we are going to take a look at the important role that goal setting plays in the financial advice process. When it comes to putting together a long term financial strategy, we place a significant emphasis on how a particular strategy ties in with a person's longer term goals and objectives and as part of our session this week, some of the key things we will look to discuss include:

• Why is goal setting such an important element when it comes to building a longer term plan?

• How do you go about ascertaining and setting both financial and non-financial goals?

• The one word question - why?

• How do we track goals over time?

• What happens when there is a clash in someone's goals?

• How do we go about lining up a financial strategy with an individuals goals?

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Market Update & Superannuation Rule Changes - In this week's Pulse Check, we are going to provide a Market Update given all the things which are occurring around the world at the current point in time. Given the conflict in Ukraine and the ongoing themes of inflation and interest rates, we thought now was an appropriate time to review the state of play and the impact these issues are having on markets.

Secondly, we will also look to discuss the changes to the superannuation rules which take effect from 1 July. Some of the key changes taking place include:

• Extension of the contribution age for superannuation to 74

• Removal of the work test requirement for individuals aged over 67

• Removal of minimum income threshold for employer contributions

• Reduction of downsizer contribution age to 60

• Increase in the limit of contributions for the First Home Super Saver Scheme

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

ASX Reporting Season - In this week's Pulse Check, we are going to discuss the reporting season here in Australia. During our session, some of the key things we will be discussing include:

• What did we learn from reporting season?

• Who surprised on the upside?

• Which companies have battled and why?

• What can we expect from the Australian economy moving forwards?

• Do we classify the overall season as a pass or fail?

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Please enjoy our latest edition of the weekly wrap where we explore the key themes that have emerged from the week.

Key Questions Facing Investors In 2022 - In this week's Pulse Check, we are going to discuss some of the key questions facing investors in 2022.

Some of the key questions which come to mind are:

• Is the rise in inflation temporary or permanent?

• Will wages growth rise too?

• How high will Australian interest rates rise?

• Is Coronavirus no longer an economic concern?

• What impact will a Russian invasion of Ukraine have on global markets?

• Will the upcoming elections impact heavily on the Australian market?

• What is the outlook for property prices?

All Things Centrelink - In this week's Pulse Check, we are going to discuss all things Centrelink given the constant change that occurs in this space.

Some of the key aspects we will look to discuss include:

• The purpose of the system

• The payments and entitlements which are available

• How Centrelink determine eligibility for payments

• What is deeming

• What options are available to individuals to either qualify or maximise their entitlements

A Look Into 2022 - In this week's Pulse Check, we are going to discuss the economic state of play and look at some of the key issues facing us in 2022.

The four key points we will look to cover in our session are:

• A market update for the past few weeks

• The return of market volatility in recent times

• A share market outlook for 2022

• What are some of the key themes that could play out over the next 12 months

It’s been just over week since we last wrote a market update about COVID-19 aka Coronavirus.

They do say when it rains it pours and the bad news has certainly started to pour in. Over the weekend it was the oil price plunge that now has given markets more to worry about. The oil price had fallen by almost 30% in trade on Monday as Russia’s decision not to follow the OPEC recommendation of cutting output to stabilise oil prices was quickly followed by Saudi Arabia’s plans to increase its output as a way of teaching Russia a lesson via a price war.

I am sure you have read over the last 24 months not only the Royal Commission into Banking and Financial Services but also the education reform, instigated by FASEA, into the education standards of financial advisers.

The Royal Commission has grabbed the headlines for obvious reasons however quietly in the background the education reforms introduced by FASEA have been ticking along forcing advisers to return to study on mass, to fill in any gaps. At the introduction of these reforms, there were approximately 26,000 licensed financial advisers across the country who all need to shape up or ship out!

January already I hear you say…… Christmas has come and gone and the aftermath of a busy and expensive time is now being digested.

So the purpose of this blog, to provide some insight about how to plan and prepare for Christmas and other expensive times of the year, such as birthdays, wedding gifts, milestone birthdays and the like.

I spend much of my time discussing cash flow with people who we work with across all stages of life and one of the consistencies is that the generosity of giving comes at a cost and for many presents a challenge to cater for. It consistently surprises me how much gifts cost not only in my household but everyone’s household and it is not surprising that it is arguably the most expensive item for every household.

I have for as long I can remember written down my dreams and aspirations and have been intuitively motivated by making progress towards these, perhaps this explains why I enjoy helping other aspirational people work towards achieving the things that matter to them most.

Last week I attended a professional training day and the speaker touched on the importance of goal setting and this was a good reminder and sparked me into action to write this blog.

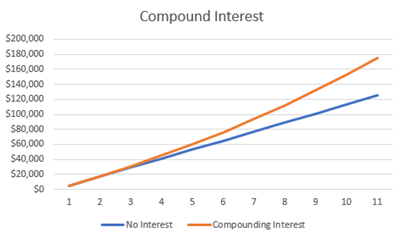

I have a small confession to make, I love compound interest!

Let’s be honest this is arguably the first money lesson that we are taught however I would argue that in the 20 years I have been working as a financial planner, this concept is still foreign to many of us.

Yesterday, I had the pleasure of spending the day visiting several wineries in the Coonawarra Wine Region in South Australia. Safe to say that I do appreciate a glass of red wine, so taking the time whilst on family holiday to visit the Coonawarra was akin to a child in a candy store.

That said, despite loving the experience of being immersed in some of Australia’s oldest wineries, what I was pleasantly surprised with was the pride and passion in which some of the wine makers discussed their history and the importance of being part of something greater than just themselves.

Last Thursday was RUOK day where we are encouraged to take a moment to ask those around us if in fact they are ok? The focus of the RUOK? movement is to specifically target suicide awareness and prevention and to support people in having open conversations about mental health.

A couple of weeks ago my blog focused on, when is a balanced investment fund, really balanced?!?

One of the key aspects of the blog was the frustration I feel for investors who try and make an informed investment decision about where to invest their hard-earned cash. Furthermore, I have for a long-time been bewildered by the fact that there has been minimal noise about the discrepancies that exist in this space.

So, it’s tax time!

The time of the year where we make that annual pilgrimage to see our Accountant, shoe box in hand, hoping that we might get a nice surprise and leave with a wheel barrow full of cash. If only it was that easy……

For some, tax time means parting with more of their hard earned and paying a tax bill whilst for others this is the best time of the year where we have a windfall for the household. Let’s not forget the retirees who are still grinning like a Cheshire cats counting their franking credits, now there is an example of the good guys winning.

Have you ever wondered what the term balanced investment means?

So where do we begin? Let’s simply focus on one investment type, a balanced fund (be that investment or superannuation) because this is arguably the most common form of investment or at the very least the default option for the majority of superannuation funds.

Have you ever tried to understand your Electricity bill?!?

I, like many, have tried and FAILED and simply put it in the “too hard basket” until I find time to complete that University Degree into how to read my electricity bill.

Now, I am not one to give up, so I rolled up my sleeves and tackled this arduous task head on and have been pleasantly surprised at what I have uncovered.

Recently I had the pleasure of spending time with dear clients who I have been working collaboratively with for the past 20 years. Wow, 20 years where has the time gone.

By way of background, when I first met them, they were your average types. Lovely people doing their best in what was a busy world, to build a life, raise a family and if possible build a decent nest egg so that they could one day enjoy the fruits of their labour. What struck me most about these clients was their humility, they simply just got on with the job of doing. Sure they played important roles but never once did they let this get in the way of their value set.

It’s a rainy Melbourne Thursday morning. I look left and watch the rain drizzle down over my street. I look right into our cute suburban backyard. It has just dawned on me that this is it – our last full day in this, our first home. Tomorrow, chaos will begin to rain down as the removalists come to move anything and everything, including a lot of stuff we have accumulated unnecessarily over the past 7 years.

Have you just made the leap to start your our own business? And are unsure about which software is best for your new venture. Or you may have been running a business, for years now and think it is time for an upgrade. It’s likely your Accountant set you up on MYOB or Quickbooks years ago. If this is you keep reading!

I have two main recommendation for my clients when it comes to software, Xero and Receipt bank (and before you ask, no this isn’t a paid commercial). The following software packages helps you reduce time and headaches associated with accounting data entry. This will make your time poor business into an efficient machine. Freeing you up to spend the time on making strategic decisions based on real-time accurate data or spending time with your fam.

So here they are...